Read articles written by Kyle Rasmussen

First American Home Warranty Review (2023)

First American offers home warranty in 35 states. Their policies are designed to protect appliances, equipment and various systems of the house.

Pioneer State Mutual Home Insurance Review (2023)

Pioneer State Mutual is a Michigan only insurance company. They offer homeowners insurance with a huge selection of additional coverages available. They have a lot of discounts available and are known for their affordable rates.

Hastings Mutual Home Insurance Review (2023)

Hasting Mutual provides home insurance policies in 6 Midwest states. They offer a lot of additional coverages to suit most homeowners' needs. Hastings Mutual has received mostly positive reviews from its customers.

QBE Home Insurance Review (2023)

QBE is an Australian insurance company offering homeowners insurance in the United States. This insurer has gotten quite a few complaints from its American customers.

Does Homeowners Insurance Cover Plumbing?

The short answer: In some cases, home insurance does cover plumbing damage and in other cases, it does not. A home’s plumbing is a common system of the house that gets damaged for various reasons. This crucial part of a home can become a major expense to repair in the event of damage. It is ... Read more

Personal Property Coverage C in Homeowners Insurance

Personal property insurance is the third section of a standard home insurance policy. The purpose of this section of coverage is to protect the homeowner’s belongings in the event of damage that is due to a covered peril in the policy.

What Is Dwelling Coverage? Coverage A Explained

Dwelling coverage or Coverage A is the first section of a standard home insurance policy. Dwelling coverage is all about protecting your house and any structures attached to it. Coverage A is the main portion of a home insurance policy and what we typically think of as homeowners insurance.

Replacement Cost Estimator: How to Calculate Home Replacement Costs

Replacement cost plays an important role in homeowners insurance. Getting an accurate estimate of the replacement cost of your home will allow to correctly size your dwelling coverage.

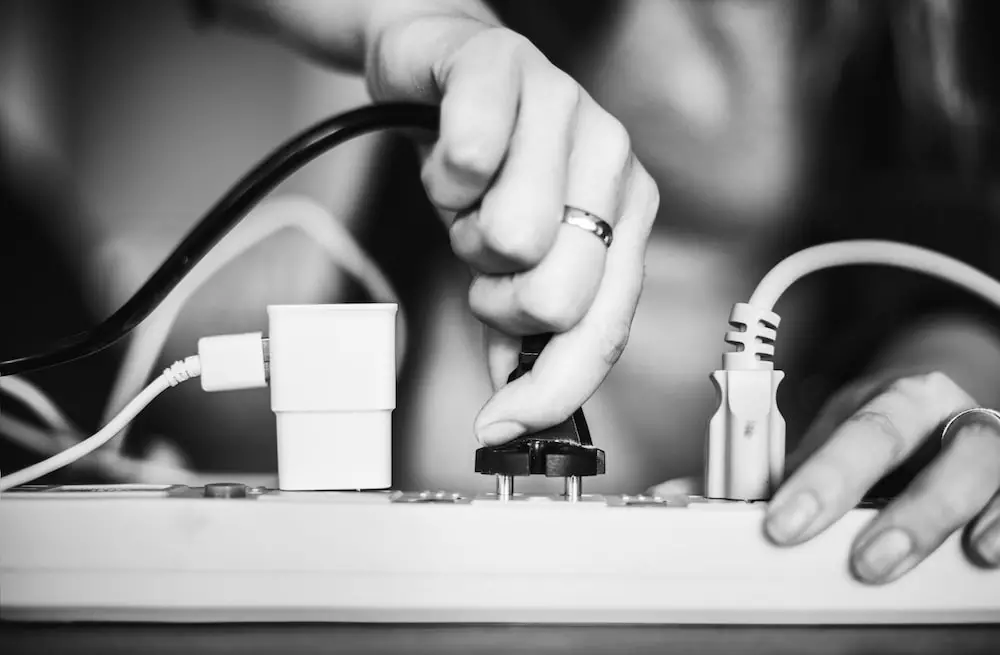

Does Homeowners Insurance Cover Power Surges?

Like with many other causes of damage, the answer to the question of whether power surges are covered by homeowners insurance is not a simple yes or no. It depends on a number of different factors, making power surges covered in some instances and not covered in others. Key facts What is a power surge? ... Read more

Does Homeowners Insurance Cover Swimming Pools?

Swimming pools are a staple for many homeowners across the country. They can be a great addition to any home, but they also pose additional risks and open up a homeowner to additional liability. According to the U.S. Consumer Product Safety Commission, roughly 3,060 kids under the age of 15 were treated in an emergency ... Read more

Earthquake Insurance

Earthquake insurance can come in the form of additional coverage or as a standalone policy. Since standard home insurance excludes earthquake damage, you need earthquake insurance to be covered from this peril.

Does Homeowners Insurance Cover Arson?

While most home insurance policies cover fire-related damage, fire damage that is due to arson is excluded from coverage. It is crucial to understand what arson is, why it is excluded, and how it may be determined to be the cause of a fire. Fire damage happens very frequently in the U.S. According to the ... Read more