Read articles written by Katelyn Huffman

Personal Articles Policy

Personal articles policy is additional insurance coverage to consider as a homeowner if you have high-value belongings. Learn how personal articles insurance policy works.

Does Home Insurance Cover Icy Sidewalk Injuries?

Homeowners insurance will cover slip and fall injuries on icy sidewalks in some cases when a homeowner is found liable. However, it is important to understand the scenarios when such injuries are not be covered.

Does Home Insurance Cover Locksmiths?

If you got locked out from your home, your standard homeowners insurance will not cover the costs of locksmiths, unless you have locksmiths endorsement included in your policy.

Does Homeowners Insurance Cover Blown-Down Fences?

Homeowners insurance covers blown-down fences in most cases. Wind damage is covered in most areas. However, if you live in a high-risk area for tornadoes, windstorms, and hurricanes, you may need to get additional coverage in order to be protected from this sort of damage.

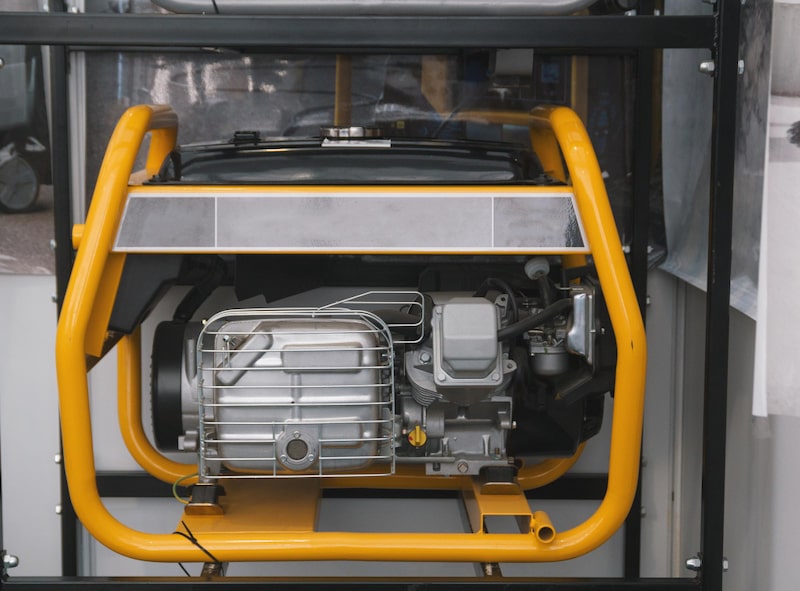

Does Homeowners Insurance Cover Generators?

A generator is covered by homeowners insurance if it gets damaged by one of the covered perils. Home insurance doesn't cover generator repair if it gets broken down mechanically due to wear and tear or due to lack of maintenance.

Does Homeowners Insurance Cover Catalytic Converter Theft?

No, catalytic converter theft would be covered by the comprehensive coverage of the auto insurance policy. Your homeowners insurance will only cover any personal belongings stolen from the interior or trunk of your vehicle.

Does Homeowners Insurance Cover Bathroom Leaks?

Bathroom leaks may be covered by standard homeowners insurance if they are sudden and accidental. Gradual leaks, sewer backups, and leaks caused by flooding are not covered unless you have additional coverages or endorsements.

Does Home Insurance Cover Attic Damage?

Your attic is covered by homeowners insurance in most cases. The attic is covered under the dwelling coverage of your home insurance policy. A typical HO-3 policy will cover attic from all risks except for the exclusions listed in the policy.

Does Homeowners Insurance Cover Drywall Repair?

Drywall damage is covered by dwelling coverage of homeowners insurance as long as the damage was caused by a covered peril. The perils that are covered differ by location and from policy to policy.

Does Homeowners Insurance Cover Stolen Packages?

Stolen packages are covered by homeowners insurance, however, unless the package's value exceeds the deductible amount, you won't be able to file a claim. It only makes sense to file a claim if your package is very expensive and it's value far exceeds the deductible amount.

Open Perils in Homeowners Insurance

HO-3 and HO-5 homeowners policies cover your dwelling and detached structures on an open-peril basis. Open-peril policies cover more risks than a more basic named peril policy.

Does Homeowners Insurance Cover Porch Damage

Homeowners insurance covers porch damage caused by many perils. The damage excluded from coverage depends on your policy. The list of excluded causes of damage can differ by location and from company to company.