Blog

Enjoy reading about homeowners insurance.

Compare home insurance quotes

Use our free comparison tool to compare rates from the best providers in your area

Explore home insurance articles

Bamboo Home Insurance Review (2023)

Bamboo offers homeowners insurance in Arizona and California. Launched in 2018, Bamboo works with various insurance carriers to bring policies that are affordable according to the its customers.

Badger Mutual Home Insurance Review (2023)

In the aftermath of the catastrophic Chicago Fire in 1871, some insurance companies refused to insure churches with tall steeples. Several others charged disproportionate premiums because such structures were highly susceptible to lightning strikes. Consequently, numerous congregations faced considerable risk. This is how Badger Mutual started as an insurance business in 1887. Badger Mutual Insurance ... Read more

Gated Community Home Insurance Discount

Where you choose to live is a very personal decision, but it can ultimately save you money on your homeowners insurance if you live in a gated community. Living in a gated community is seen as a safe option by insurance carriers, and many are willing to offer discounts on premiums because of this. Knowing ... Read more

SURE Home Insurance Review (2023)

SURE is a newer insurance provider offering homeowners insurance policies in 7 southern coastal states. Founded in 2021, SURE is partnered with SageSure to offer insurance.

Amica Mutual Home Insurance Review (2023)

Amica is a well-established insurance company offering homeowners insurance in 48 states. This insurance company has scored a #1 spots in J.D. Power's customer satisfaction and claims satisfaction surveys.

Does Home Insurance Cover Crawl Space Damage?

Yes, homeowners insurance covers crawl space damage if the damage was caused by a covered peril. However, there are some cases when it will not be covered.

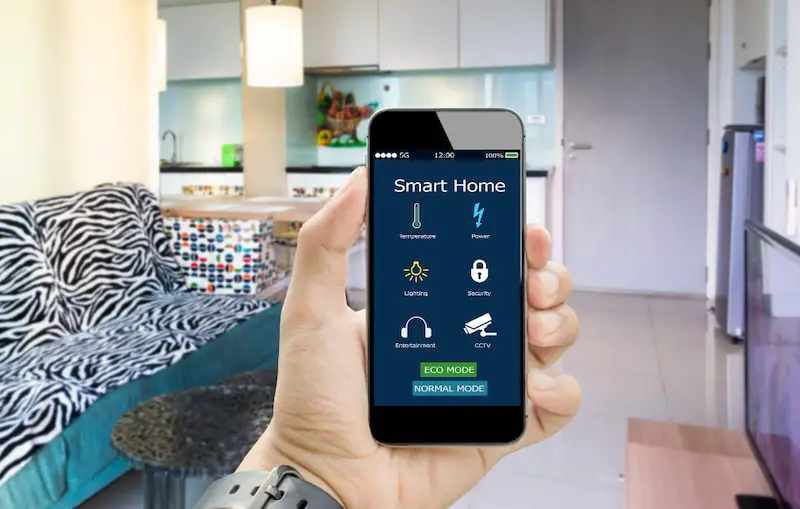

Smart Home Insurance Discount

Smart home homeowners insurance discount is a type of discount that some homeowners insurance companies offer to customers who install smart home devices in their homes.

Short Term Rental Insurance

Short-term rental homeowners insurance is a type of coverage that protects homeowners who rent out their property or a part of it to guests for a short period of time, usually less than six months.

Inland Flood Insurance Coverage

Inland flood insurance coverage is a type of protection that covers damage caused by surface water originating from rain, snow, overflowing rivers, lakes, and other bodies of water.

Castle Key Home Insurance Review (2023)

Castle Key is a Florida-only insurer owned by Allstate. This company offers homeowners, renters, landlord, condo and mobile home insurance policies. There are many complaints that we found posted online from Castle Key's customers.

Ocean Harbor Home Insurance Review (2023)

Ocean Harbor is an insurance company specializing in coastal homeowners insurance policies available in 5 states. They offer a few additional coverages and discounts. We found quite a few complaints from their customers online.

Branch Home Insurance Review (2023)

Branch Insurance is a new insurance company launched in 2020. It offers homeowners insurance in 37 states and has received mostly positive reviews from its customers.