Additional Coverages

Enjoy reading about homeowners insurance.

Compare home insurance quotes

Use our free comparison tool to compare rates from the best providers in your area

Explore home insurance articles

Permitted Incidental Occupancies Endorsement in Home Insurance

Permitted incidental occupancies endorsement is additional coverage that can be added to homeowners insurance policies. This endorsement is meant to provide protection for small home-based businesses.

Personal Articles Policy

Personal articles policy is additional insurance coverage to consider as a homeowner if you have high-value belongings. Learn how personal articles insurance policy works.

Windstorm Insurance

Windstorm insurance is designed for areas where wind and hail damage is common and home insurance excludes these perils from their standard homeowners insurance. Usually, windstorm insurance can be added to home insurance policy, but in some cases, it can be a standalone policy.

Service Line Coverage for Homeowners Insurance

Service line coverage is usually available as additional coverage that can be added to homeowners insurance in a form of endorsement or rider.

What is Sewer Backup Insurance?

Sewer backup coverage will protect the homeowner from backups of the sewage system, broken lines, and reimbursement for repairs needed as a result of the damage. The coverage also reimburses the homeowner for expenses related to removing standing water and sewage that may accumulate in the home.

Identity Theft Insurance Coverage

Identity theft insurance is often offered as standalone coverage or as additional coverage for homeowners insurance policies. Some insurance companies include identity theft coverage in their standard homeowners policies.

Watercraft Endorsement for Homeowners Insurance

Watercraft endorsement is an add-on coverage for homeowners insurance to cover your boat. While it provides less coverage than boat insurance, it provides more protection than standard homeowners insurance.

Ordinance or Law Coverage

Ordinance or law coverage is an add-on insurance coverage for homeowners insurance. It covers the cost of re-building the home to local building code requirements after it has been damaged or destroyed by a covered event.

Personal Property Coverage with Replacement Cost Value

When selecting a homeowners policy, you will be faced with many decisions. A lot of math, state minimums, and endorsements will be reviewed and added to the policy to ensure it is comprehensive and matches your needs and the requirements of a mortgage company. When it comes to personal property coverage C, you will be ... Read more

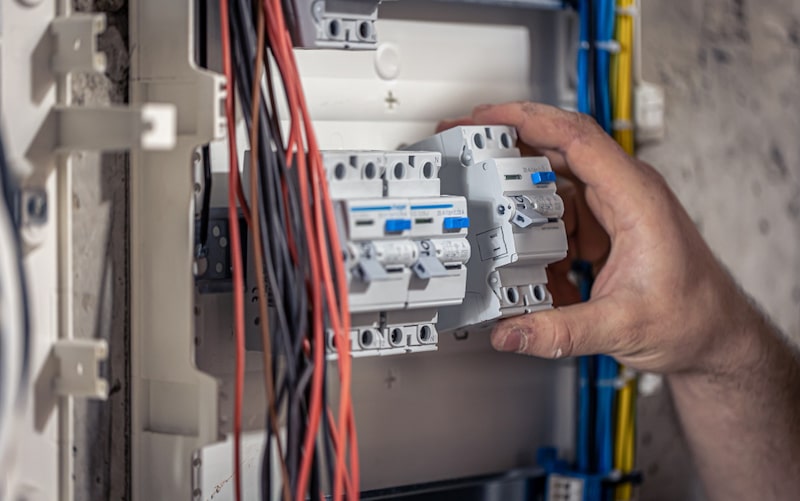

Equipment Breakdown Coverage: Details, Cost & Claim Examples

When you have an existing homeowners insurance policy, there are endorsements that can be added to provide additional coverage. If you have equipment breakdown coverage on your policy, this will protect your appliances that are affected by electrical or mechanical issues. If you have a washing machine, dryer, dishwasher, stove, and other similar appliances, it ... Read more

Home Insurance Endorsements

An endorsement, also known as riders or options, is an additional product which will allow you to raise whatever limitations your homeowners insurance may have. Using an endorsement is one of the best ways to enable you to stretch the limits of your home insurance coverage. As a homeowner, while you may have insurance coverage ... Read more

Earthquake Insurance

Earthquake insurance can come in the form of additional coverage or as a standalone policy. Since standard home insurance excludes earthquake damage, you need earthquake insurance to be covered from this peril.