Homeowners Guide

Enjoy reading about homeowners insurance.

Compare home insurance quotes

Use our free comparison tool to compare rates from the best providers in your area

Explore home insurance articles

Gated Community Home Insurance Discount

Where you choose to live is a very personal decision, but it can ultimately save you money on your homeowners insurance if you live in a gated community. Living in a gated community is seen as a safe option by insurance carriers, and many are willing to offer discounts on premiums because of this. Knowing ... Read more

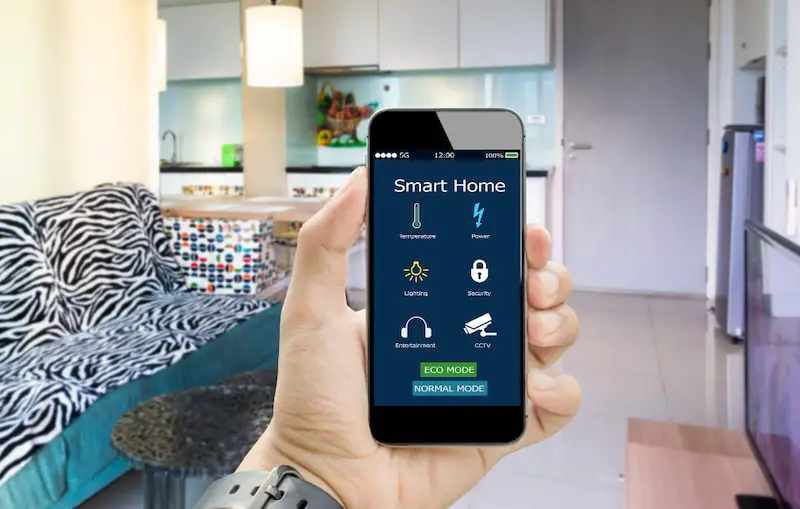

Smart Home Insurance Discount

Smart home homeowners insurance discount is a type of discount that some homeowners insurance companies offer to customers who install smart home devices in their homes.

Reddit Cheap Homeowners Insurance Tips

Learn the best savings tips for home insurance from Reddit. We gathered all the best info about getting cheap homeowners insurance on this popular social network.

California FAIR Plan: Everything You Need to Know

California FAIR plans are meant for homeowners who live in high-risk areas and have trouble getting homeowners insurance from insurance companies directly.

Does Home Insurance Cover Locksmiths?

If you got locked out from your home, your standard homeowners insurance will not cover the costs of locksmiths, unless you have locksmiths endorsement included in your policy.

Construction Types and Home Insurance

Many insurance companies consider the type of construction used to build your home as a factor to determine your homeowners insurance rates. Learn how materials used to construct your home's structure can affect your premiums.

Does Homeowners Insurance Cover Catalytic Converter Theft?

No, catalytic converter theft would be covered by the comprehensive coverage of the auto insurance policy. Your homeowners insurance will only cover any personal belongings stolen from the interior or trunk of your vehicle.

Is Homeowners Insurance Based on Property Value?

No, in most cases homeowners insurance coverage is not based on property value. Dwelling coverage is usually based on the replacement cost of the home which can differ greatly from the property value.

Homeowners Insurance for a Duplex

Home insurance for a duplex home is typically no different from homeowners policies for standard single-family homes. If you are renting out both halves of the duplex, you may need to obtain a dwelling fire landlord insurance policy instead of a regular homeowners plan.

Does Homeowners Insurance Cover Porch Damage

Homeowners insurance covers porch damage caused by many perils. The damage excluded from coverage depends on your policy. The list of excluded causes of damage can differ by location and from company to company.

Does Homeowners Insurance Cover Guest Houses?

Standard homeowners insurance typically covers your guest house as long as you do not rent it out. Other structures coverage B covers the structure of your guest house. Read the whole article to learn what else is covered, what is not covered, and what insurance you might need to get if you are renting your guest house out.

Does Homeowners Insurance Cover Kitchen Cabinets?

Kitchen cabinets are considered to be part of your home, so dwelling coverage A of your homeowners policy will cover kitchen cabinet damage as long as it is caused by a covered peril. A standard HO-3 policy will cover kitchen cabinets on open-peril basis.