Home insurance is one of the most important investments you can make as a homeowner in Buffalo. Not only does it provide financial protection against unexpected events like fires or thefts but also offers liability coverage if someone gets injured on your property.

It’s important to understand that standard home insurance policies typically do not cover natural disasters such as floods or earthquakes; hence you may need additional policy coverage for these types of events. Furthermore, each policy differs depending on what is covered (e.g., dwelling coverage versus personal property protection) so choosing the right coverage levels will help ensure that you have adequate protection when disaster strikes.

In addition to protecting homeowners financially against unforeseen events or damages – an essential aspect of any home insurance policy – having a good insurance policy means peace of mind knowing your home is protected all year round. And especially considering unpredictable weather patterns throughout the year like ice storms which may cause power outages or roof damage due to heavy snowfall – having an excellent home insurance policy makes sound financial sense.

As such, it is important for homeowners in Buffalo to take the time to research their options and understand what coverage levels will best suit their needs. By taking steps to protect your home with an adequate insurance policy, you can rest easy knowing that you are prepared for anything life throws your way.

Buffalo, NY is a city rich in history and culture. Founded in 1789, it has a long and storied past that includes everything from being a major transportation hub to serving as the capital of the world’s largest grain-milling center. Today, Buffalo is best known for its vibrant arts scene, bustling waterfront and world-famous chicken wings.

However, living in such a historic city can come with its own unique risks when it comes to homeownership. With harsh winters and unpredictable weather patterns that can bring everything from heavy snowfall to strong winds and even flooding, it’s important for homeowners in Buffalo to ensure that their properties are protected with adequate home insurance coverage.

The Price You Pay: Premiums for Home Insurance in Buffalo

If you’re a homeowner in Buffalo, NY, then you know how important it is to have home insurance. But what factors actually determine the cost of your premiums? There are several things that could impact how much you’ll pay each month or year for your policy.

- One major factor is the age and condition of your home. If you live in an older house that hasn’t been updated recently, then you may be considered a higher risk for insurance companies. This is because older homes can be more prone to damage from things like water leaks or electrical problems. Another factor that could affect your premiums is the location of your home.

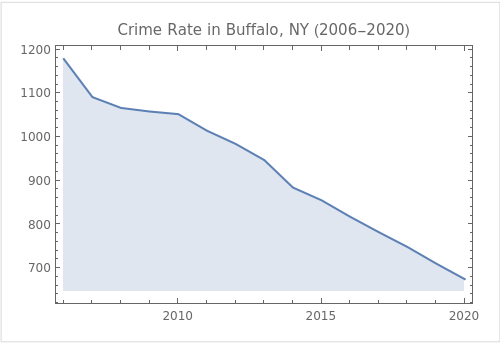

- If you live in an area that’s known for high crime rates or natural disasters (like flooding), then your insurance company might charge you more to insure your property. On the other hand, if you live in a low-risk area with little crime or few natural disasters, then you might be able to get a lower premium.

- Your credit score could also play a role in how much you’ll pay for home insurance. Insurance companies often use credit scores to help determine risk factors when calculating premiums. So if you have poor credit, then it’s possible that you could end up paying more for coverage. So just how much can homeowners expect to pay for home insurance in Buffalo?

According to recent data from ValuePenguin, the average cost of home insurance in Buffalo is around $952 per year (or $79 per month). This puts Buffalo slightly above the state average; homeowners across New York state pay an average of around $980 per year for their policies.

It’s worth noting that these are just averages and individual premiums can vary widely based on factors like coverage limits and deductibles. However, understanding some of these key factors can help homeowners make informed decisions about their coverage options and budget accordingly when shopping around for home insurance.

Types of Coverage Available for Homes in Buffalo

When it comes to home insurance, there are various types of coverage that homeowners in Buffalo should be aware of. The most common type is dwelling coverage, which covers the physical structure of your home if it’s damaged or destroyed by a covered peril such as fire, theft, or vandalism.

Another important type is personal property coverage which reimburses you for the cost of lost or damaged belongings, such as furniture and electronics. In addition to these basic coverages, there are other types that can be added to your policy.

For instance, personal liability coverage protects you against lawsuits if someone gets injured while on your property. Medical payments coverage provides assistance with medical bills if a guest is injured on your property and doesn’t want to sue you.

Additional Coverages that May be Beneficial for Homeowners in Buffalo

One additional coverage that can be beneficial for homeowners in Buffalo is flood insurance. Though not required by law unless you live in a designated flood zone, it’s important to note that standard home insurance policies do not provide protection against flooding damage caused by natural disasters such as hurricanes or heavy rains. Flooding can occur anywhere and at any time; therefore adding this form of insurance can protect you from costly damages and financial loss.

Another option available is earthquake insurance covering damages caused by an earthquake, although rare it’s important to consider especially after considering how much damage could result from an earthquake.

To ensure full protection homeowners may also purchase an umbrella policy which increases liability limits beyond what is provided by their base policy.

Ultimately, when choosing additional coverages for your home insurance policy in Buffalo, it’s important to assess the specific risks associated with living in the area and evaluate which additional policies will provide the most comprehensive protection at an affordable rate. Remember: It’s always better to have more coverage than less.

The Best Home Insurance Companies in Buffalo, NY

When it comes to choosing the right home insurance company in Buffalo, NY, there are many options available. The top 10 home insurance companies operating in the area are ranked based on their coverage options and premium rates.

- State Farm: This is by far one of the most popular home insurance companies operating in Buffalo, NY. State Farm offers a broad array of coverage options at affordable rates. They also offer discounts for bundling policies and installing security systems.

- Allstate: Allstate is another well-known home insurance company with a strong presence in Buffalo, NY. They offer a comprehensive range of coverages that can be customized to meet individual needs.

- Liberty Mutual: Liberty Mutual offers some of the most competitive premium rates among all home insurance providers in Buffalo, NY. They also offer unique coverages such as replacement cost coverage for personal belongings.

- Nationwide: Nationwide is another affordable option for those looking for quality home insurance coverage in Buffalo, NY. They have a range of discounts available including bundling policies and having protective devices installed.

- USAA: USAA is an exclusive insurer that provides coverage exclusively to military members and their families at reasonable prices with excellent customer service.

- Erie Insurance: Erie Insurance has been providing quality coverage to homes across America for over 90 years now with their customizable policies.

- MetLife Auto & Home: MetLife offers comprehensive protection at competitive rates along with discount opportunities like multi-policy discounts and being claim-free. Although Metlife has been acquired by Farmers, it remained one of the recommended choices for homeowners in Buffalo, NY.

- Travelers Insurance: Travelers Insurance has various policy options that deliver excellent customer service while covering your property against various risks like fires or accidents.

- Chubb: Chubb Ltd.’s high-quality policies come with perks like risk evaluation services from certified professionals making it ideal for homes that require unique coverage options.

- Farmers Insurance: Farmers Insurance provides many insurance products while ensuring that their policyholders are adequately covered and well-informed through their mobile app.

Comparison of Their Coverages and Premiums

Each of these top 10 home insurance companies in Buffalo, NY provides a different level of coverage at varying rates. While it is important to consider the cost, it is also essential to look at the policies’ specifics. For instance, while one company’s rate may be low, its coverage may not provide what you need.

Comparing policies from different providers can be daunting. However, it’s necessary to ensure you get the best deal possible.

Consider looking at each company’s exclusion clauses for natural disasters like floods or fires before making a decision. Overall, taking time to review and compare policies from different providers can lead to significant savings in premium costs without compromising the quality of your home insurance coverages in Buffalo, NY.

Maximizing Your Home Insurance Savings in Buffalo, NY

No one wants to pay more than they have to for home insurance. Fortunately, there are several ways you can save money on your policy in Buffalo, NY.

Here are a few tips to help you maximize your savings:

- Bundling Policies: Many insurance companies offer discounts for bundling multiple policies together. Consider combining your home insurance policy with an auto or life insurance policy to take advantage of these savings.

- Maintain Good Credit: Believe it or not, having good credit can help lower your home insurance premiums. Insurance companies view individuals with good credit as less risky and are likely to offer them lower rates.

- Security Systems: Installing a security system in your home can go a long way in reducing the risk of theft or damage caused by break-ins. Because of this, many insurers offer discounts for homes with security systems installed.

Discounts Offered by Top Home Insurance Companies in Buffalo

In addition to the above tips, many home insurance companies operating in Buffalo also offer specific discounts that can help you save even more on your policy. Here are some discounts offered by the top home insurance companies in Buffalo:

- Allstate: Allstate offers various discounts including multi-policy (bundling), claim-free, early signing discounts, and welcome/birthday bonuses for customers who maintain coverage year after year.

- Nationwide: Nationwide offers substantial discounts such as multi-policy, claims-free (10% off), easy pay sign-up discounts, and paperless documents option that give customers the opportunity to save additional money on their premiums each year.

- State Farm: state farm provides discounts such as multi-policy discounts, home alert protection (alarm system or smart home technology), impact-resistant roofing and energy-efficient upgrades.

- Progressive: Progressive offers discounts including multi-policy, online quote, paperless documents options, and claims-free discounts. Moreover, they allow customers to customize their coverage by choosing add-ons such as jewelry coverage or pet injury coverage.

By implementing these tips and taking advantage of the discounts offered by various insurance companies in Buffalo, you can save a significant amount of money on your home insurance policy. Be sure to shop around and compare rates to find the best deal for you.

Step-by-Step Guide on How to File a Claim with Your Home Insurance Company

Filing a home insurance claim can be a stressful and overwhelming process, but it doesn’t have to be. Here’s a step-by-step guide on how to file a claim with your home insurance company in Buffalo, NY:

- Contact Your Insurance Company: The first step is to contact your insurance company as soon as possible after the incident occurs. You can either call them directly or file the claim online through their website.

- Provide Details of the Incident: When you contact your insurance company, they will ask you for specific details about the incident that led to the damage or loss of your property. Be sure to provide as much information as possible, including photos and videos if you have them.

- Meet with an Adjuster: After filing your claim, an adjuster from your insurance company will reach out to schedule an inspection of the damage or loss. They will assess the extent of the damage and provide an estimate for repairs or replacement.

- Receive Payment: Once your claim is approved and processed by your insurance company, you will receive payment for damages based on the coverage outlined in your policy.

Tips on How to Make The Claims Process Smoother and Faster

Filing a home insurance claim can take time, but there are steps you can take to make the process smoother and faster:

- Keep Records: Keep detailed records of all communication with your insurance company, including dates, times, and names of representatives you spoke with.

- Document Everything: Take photos and videos of any damage or loss as soon as it occurs so that you have proof when filing a claim.

- Understand Your Policy: Read through your policy carefully so that you understand what is covered and what is not covered by your home insurance.

- Be Prepared: Have all necessary information ready when you make the claim such as your policy number, date of incident and details about the damage.

By following these tips, you can help ensure that your home insurance claim is processed quickly and efficiently. Don’t hesitate to ask your insurance company for more information or clarification at any point during the claims process.

Frequently Asked Questions

What Does My Home Insurance Policy Cover?

This is one of the most common questions that homeowners have when it comes to their home insurance policies. In general, a standard home insurance policy provides coverage for your dwelling, personal property, liability and medical payments to others.

Dwelling coverage protects your home’s structure against perils like fire and windstorm. Personal property coverage protects the things inside your home like furniture, electronics and clothing in case they are damaged or lost due to a covered peril.

Liability coverage pays for damages you may be held responsible for if someone else is injured on your property or if you cause damage to someone else’s property. It’s important to understand that there may be limits and exclusions on your policy that affect what is covered.

For example, some policies may exclude coverage for certain types of damage like floods or earthquakes. To make sure you have the right level of protection, it’s important to review your policy with an agent who can help identify any gaps in coverage.

How Much Liability Coverage Do I Need?

Liability coverage is included in most standard home insurance policies and provides protection against lawsuits arising from bodily injury or property damage caused by you or members of your household. The amount of liability coverage you need depends on a few factors such as the value of your assets and perceived risk level.

If you have significant assets or a high-risk occupation (like a business owner), you may want to consider higher liability limits than what is typically provided in a standard policy. A good rule of thumb is to consider liability limits that are at least equal to the total value of all assets owned by yourself and anyone else living with you.

Is Flooding Covered Under My Home Insurance Policy?

Standard homeowner policies do not cover flood-related damages which can occur due to heavy rainfalls and storms in Buffalo. Homeowners who live in a flood-prone area or close to water bodies may need additional coverage through the National Flood Insurance Program (NFIP). It’s important to note that there is typically a 30-day waiting period before flood insurance coverage takes effect, so it’s best to purchase this type of coverage well in advance of any potential flooding events.

What Discounts Are Available for Homeowners?

Discounts on home insurance premiums can help homeowners save money on their policy. Some common discounts available may include bundling your home and auto policies with the same insurer, installing smoke detectors and security systems, having a good credit score and being a nonsmoker.

Be sure to ask your agent or insurer about any discounts that are available when shopping for home insurance policies. There are many ways you can save money without sacrificing coverage.

Conclusion

Getting the right home insurance for your property in Buffalo, NY is essential. It is important to assess your personal needs and compare policies from top-rated companies in the area to ensure you get the coverage you need at a reasonable cost.

When considering purchasing a policy, it’s crucial to understand all of the factors that can impact your premiums and coverage options. By taking advantage of discounts and savings opportunities, such as bundling policies or installing security systems, you can save money on your premiums while still ensuring adequate protection for your home.

Additionally, it’s important to stay informed about any changes in regulations or laws that may affect your policy. As Buffalo continues to grow and develop, new risks may arise that require additional coverage.

Stay up-to-date on current events and consult with your insurance provider regularly to ensure that you are fully protected against potential losses. Remember that having home insurance not only protects yourself and your property but also provides peace of mind knowing that you are covered in the event of an unexpected disaster.

By taking the time to carefully consider different policies and companies available in Buffalo, NY, you can find a policy that best suits your individual needs while still being affordable. In short – protect yourself and secure peace of mind with appropriate Home Insurance.