Homeowners Guide

Enjoy reading about homeowners insurance.

Compare home insurance quotes

Use our free comparison tool to compare rates from the best providers in your area

Explore home insurance articles

What Is A Homeowners Insurance Binder?

A lot of homeowners, especially those who just purchased a new home, are usually confused about the term Insurance Binder. To be very simple about it, a Homeowners Insurance Binder is a temporary document which acts as your insurance policy while the actual policy has not yet been completed. The sole purpose is to verify ... Read more

Homeowners Insurance Declaration Page

Whenever you purchase any insurance policy, you will receive a multi-page document. These documents will usually include plenty of information about your insurance coverage. Many policy owners usually do not take the time to review each page, just because of the sheer number of items that need to be checked. Thankfully, you will be able ... Read more

Does Homeowners Insurance Cover Swimming Pools?

Swimming pools are a staple for many homeowners across the country. They can be a great addition to any home, but they also pose additional risks and open up a homeowner to additional liability. According to the U.S. Consumer Product Safety Commission, roughly 3,060 kids under the age of 15 were treated in an emergency ... Read more

Does Homeowners Insurance Cover Vandalism?

Having a homeowners insurance coverage of the best ways to protect your home and the rest of your property. Some of the most common perils like fire damage, windstorm, and burglary are issues that are covered by a homeowner’s insurance. What many homeowners do not know that vandalism is also covered by most home insurance ... Read more

Home Insurance For Farms And Ranches

Having a farm and ranch insurance provides protection for your property which may include your home, agricultural, and livestock. If you live in a farm, rural home, or a ranch, you may want to consider this unique insurance policy that will provide you with wider coverage. Farm insurance is a combination of both home and ... Read more

Home Insurance For Townhouse

Homeowners who live in a townhome, townhouse, or rowhouse are typically not required to purchase an insurance policy. Nevertheless, there are times when your mortgage lender, homeowner’s association, or landlord will require you to get coverage. Depending on your specific situation, you may need renters insurance, condo insurance, or standard homeowners insurance (HO-3). Even if ... Read more

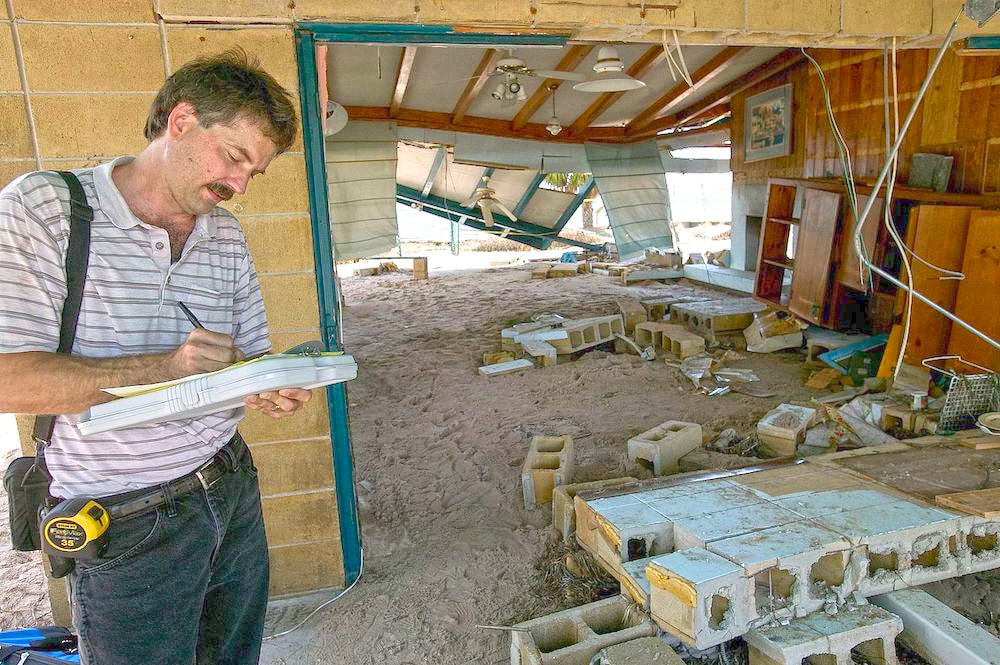

How To Deal With An Insurance Adjuster

When you need to make a claim, one of the most common processes that you need to go through is to work with an insurance adjuster. Claims adjuster are trained professionals who will visit your property and assess the extent of the damage. If you have never dealt with an insurance claims adjuster before, it ... Read more

All-Risk Homeowners Insurance

Does your all-risk homeowners insurance provide coverage for all types of damages that may happen to your home? We know that this type of insurance comes with a pricier premium, but is it worth paying the high price? Find out if it is best to the all-risk homeowners insurance can provide you with the peace ... Read more

Does Homeowners Insurance Cover Sinkholes?

Sinkholes are no longer uncommon in the US, which is why more and more homeowners are looking into their insurance policy to see if they are protected against damage caused by sinkholes. Standard homeowner’s insurance policies would often cover for sinkholes, but there are some homeowners that opt out of this coverage to limit their ... Read more

How To Get Homeowners Insurance After Being Dropped

It is a normal day for you. You open your e-mail or your mailbox and there it was… a message from your insurance company that says your insurance policy is being dropped. You begin to panic and ask yourself this question: How will I get homeowners insurance after being dropped? This may not be a ... Read more

Is Homeowners Insurance Negotiable?

To help protect one of your biggest investments, lenders will require you to purchase a home insurance policy before the closing proceeds and it’s not negotiable if you have a mortgage. If your mortgage is paid off, you are not required to have homeowners insurance, but it is still highly recommended to protect you financially. ... Read more

Modular And Manufactured Home Insurance

We get homeowners insurance for our home. We purchase car insurance for our cars. On the other hand, travel insurance is purchased whenever we travel. However, what if your house is on wheels? What type of insurance should you get? What if your home was made in the factory and not on-site? The growing popularity ... Read more