When you need to make a claim, one of the most common processes that you need to go through is to work with an insurance adjuster. Claims adjuster are trained professionals who will visit your property and assess the extent of the damage. If you have never dealt with an insurance claims adjuster before, it can easily become intimidating.

What is An Insurance Claims Adjuster?

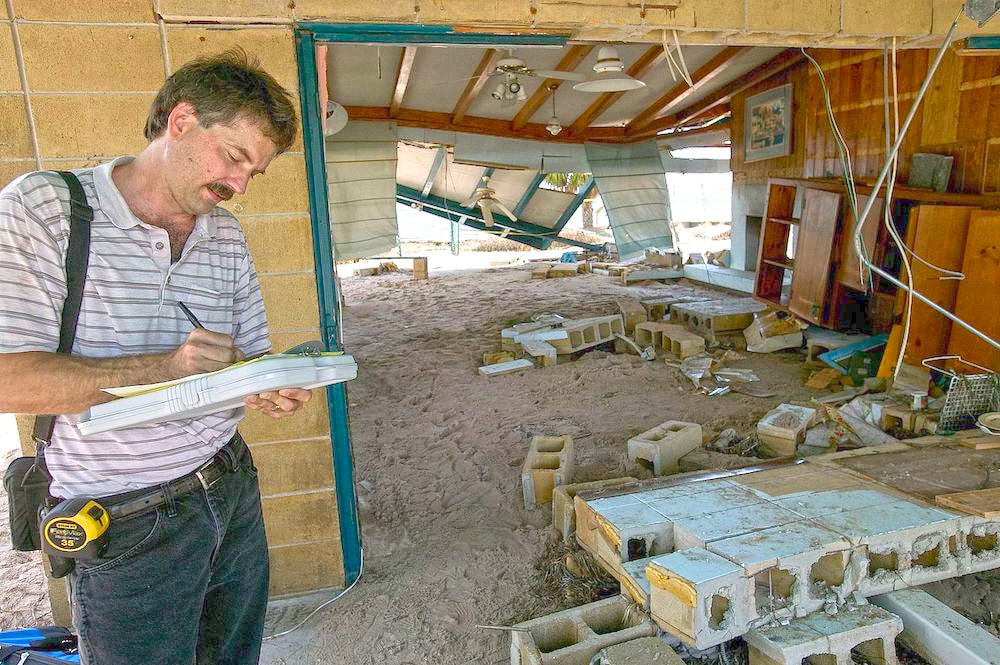

Any insurance company uses the services or employs an insurance adjuster to evaluate your claim. They are usually trained to check the status of your property and the damage that occurred. The work of the adjuster is to evaluate your claim and eventually they are the ones who will decide the amount of money the insurance company will have to pay.

An insurance claims adjuster is employed or contracted by the company to act on their behalf, so their goal is to protect the insurance provider as much as possible. Take note, that any insurance company no matter how well reviewed will want to pay out the least amount that is legally possible.

Insurance companies may call their claims adjuster a representative, an analyst, or some other job title. Whatever their title may be, their main goal is to evaluate your claim and close it as soon as possible for the least amount of pay-out. In most cases, many homeowners end up disagreeing with the insurance adjuster because of low estimates.

2 Types of Insurance Adjusters

You may not know that there are two types of claims adjusters. During major accidents or natural disaster, you may get contacted by public adjusters. Public adjusters are independent adjusters who are not hired by the insurance company. Since they are not hired by the company, you do not have to worry about them looking out for the insurance provider.

However, their services will not come for free. Take the time to review their qualifications and references and check with the National Association of Independent Insurance Adjusters. Public insurance adjuster fees can vary depending on the state. They usually charge anywhere from 10-20% of your settlement. So for a $20,000 loss, a public adjuster may charge as much as $2,000 to $4,000.

The other type of adjuster was formerly mentioned above is the one hired by the insurance company. They will contact you once you start processing your claim to review the damage. It is good to note that staff insurance adjuster provides their services for free. Additionally, it is also common for homeowners to dispute the findings of an adjuster from the insurance provider.

Tips on Negotiating with Your Home Insurance Company Adjuster

A lot of homeowners easily get intimidated with an insurance company adjuster. One thing that you need to remember, most insurance companies will offer low initial payout because they always expect that the insurance holder will negotiate the initial amount. In some cases, homeowners even hire a public adjuster. So as a homeowner, do not be automatically discouraged with a low offer, instead expect to negotiate this offer with your insurance provider. While negotiating, remember these crucial tips:

- Acting in Good Faith – Your insurance company legally needs to act in good faith. When you purchase insurance coverage, you and the insurance company entered a mutual contract. This contract states that with covered damage, your insurance company must pay you for it. Therefore, they are required by law to fulfill this contract in good faith. If the insurance company is intentionally stalling, refusing, or failing to pay you for the damage, they are acting in bad faith and therefore opening themselves to lawsuits.

- Take Control – An insurance adjuster may be looking into several claims every week. However, you are in-charge only of your own claim. Since you are expert of your own claim you should be able to expertly negotiate it with your claims adjuster.

- Gather Receipts – Receipts are crucial when making a claim. If you can, make sure to keep a copy of all your documents including the receipts.

- Give the Claims Adjuster Information – Your insurance adjuster will be looking at structural damage, personal property damage, and other important damages that are included under your policy. Make sure to call his or her attention to any other losses that may be caused by a covered peril. Never leave anything until the claims adjuster has officially recorded it.

What To Do If an Agreement Failed

If the payout offer is too low, you can always ask for additional justification from your claims adjuster. You can even ask them to list down the damage and include facts to support their numbers. If this does not work, you can contact the company directly to negotiate with a claims manager. Your last option is to consider getting a public claims adjuster and see if this is worth the extra expense.