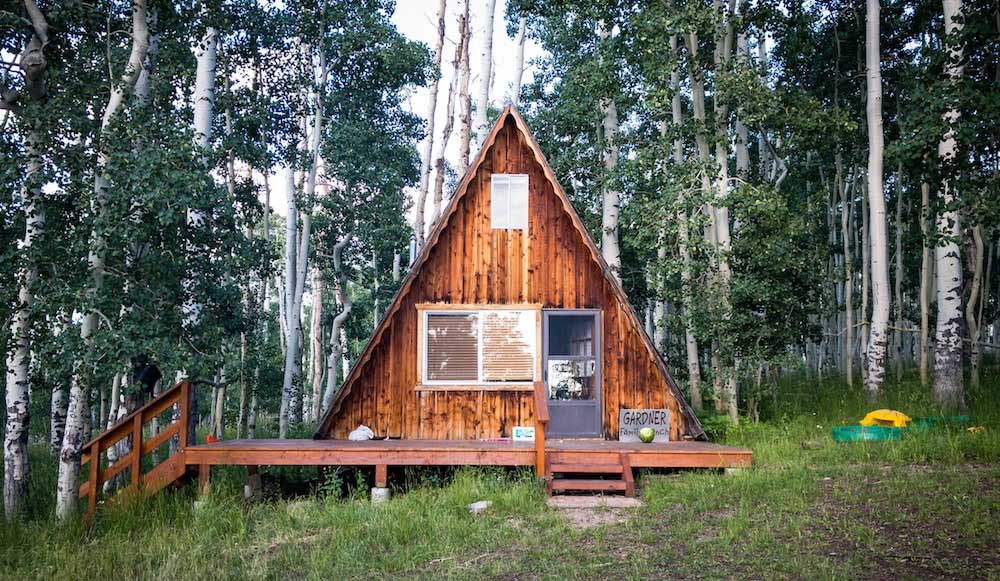

Imagine spending your days away from the bustle of your daily life in a cottage with a scenic mountain view, a tranquil lakeside cabin, or in a villa by the sea. Imagine having a vacation home that you look forward to going to – such a sight to behold. But before you jump into buying your dream vacation home, bear in mind that you might have to consider some risks that are even bigger than your primary home. While the factors that affect a secondary home insurance premium will be similar to that of your primary residence, the risks that involve in owning a vacation home can be greater.

Like any other home insurance, the premium for secondary home insurance will depend on the cost of rebuilding the home and the risks that come with it. Inherently, a vacation home that you only visit for a few days in a year would entail greater risks. Since the vacation house will be unoccupied most of the time, the chances of burglary or vandalism are greater. Also, because no one is around most of the time, any damage due to leaks, insect infestation, or exposure to the elements will go unchecked for longer than normal periods of time. These factors along with the location and contents, greatly determine the risks that insurers would have to underwrite.

What are the available options for Vacation Home Insurance?

Generally, the insurer of your primary home will be a good company to consider. If your policy provides for a possible add-on option for your secondary home, there’s a big chance that your premium can be lower compared to securing independent secondary home insurance for your vacation home.

If you opt for getting an add-on, be sure to check if the coverage is practical enough that you can feel secure in any eventuality. Aside from covering the cost of rebuilding your vacation home, you may have a boat, a pergola, or a swimming pool that you also want to be included in the policy. The key will be discussing the details with your agent so you don’t end up getting an add-on that turns out to be insufficient and impractical.

If your primary home insurer doesn’t provide for a secondary home endorsement, there’s no other way but to buy an independent policy for your vacation home. But before making that big decision, a thorough understanding of the risks will be your best tool towards having your confidence and peace of mind.

What makes secondary home insurance expensive?

Other than the cost of rebuilding your secondary home, there will be factors that are peculiar to it, being a seasonal place of stay.

- Location. As in the case of any home insurance, a house that is built on an earthquake-prone area will command a higher premium. If your vacation home is located in an area that is prone to flooding, or it’s close to the shoreline where it could be susceptible to a hurricane, the cost of having it insured will definitely be bigger. As always, better check for the inclusions and do a comparison.

- Absence of a caretaker. A caretaker’s value doesn’t just rest on keeping the place clean while you are away. Without anybody to maintain, to check for damages (natural and man-made) or to protect your property from burglary or vandalism, your insurer will require a higher premium.

- High-value items or structures within your property. If you keep a boat or expensive sports equipment, or you have a swimming pool or a gazebo within your yard, you might want to have them covered. Homeowners insurance companies differ in the flexibility of covering such additional items or structure. But even if your current or prospective insurer does have one, more risks mean bigger premium payments.

Are there ways to make the premium lower?

Fortunately, yes! Here are some ways you can do to keep premium at the lowest possible.

- Insurers generally offer discounts for having a security alarm. Although the discounts differ between insurance companies, any reduction in the price tag is definitely a welcome scenario. If your secondary home has one, you have fewer risks of a burglary and you have fewer chances of filing a claim.

- Keep the risks at bay by proving to your insurer that you have addressed any possibility of roof leakage, water damage from cracked walls and that your electrical or plumbing systems have been updated. However remote these instances might be, the mere fact that you have them fixed lessens the chances of additional risks.

- Do your homework and compare insurance providers. Know what you need. The cost can be relative when it comes to the level of coverage.

A vacation home makes lasting memories for the family. It’s a refuge away from the troubles of your busy life and a place where you enjoy life with the ones that you love and care about. But before buying one, it’s best to consider the value in its entirety and beyond the upfront price tag. Choosing the best secondary home insurance gives you confidence and peace of mind that the place you look forward to visiting is secured and well-covered.